Simplifying Access to Your Benefits

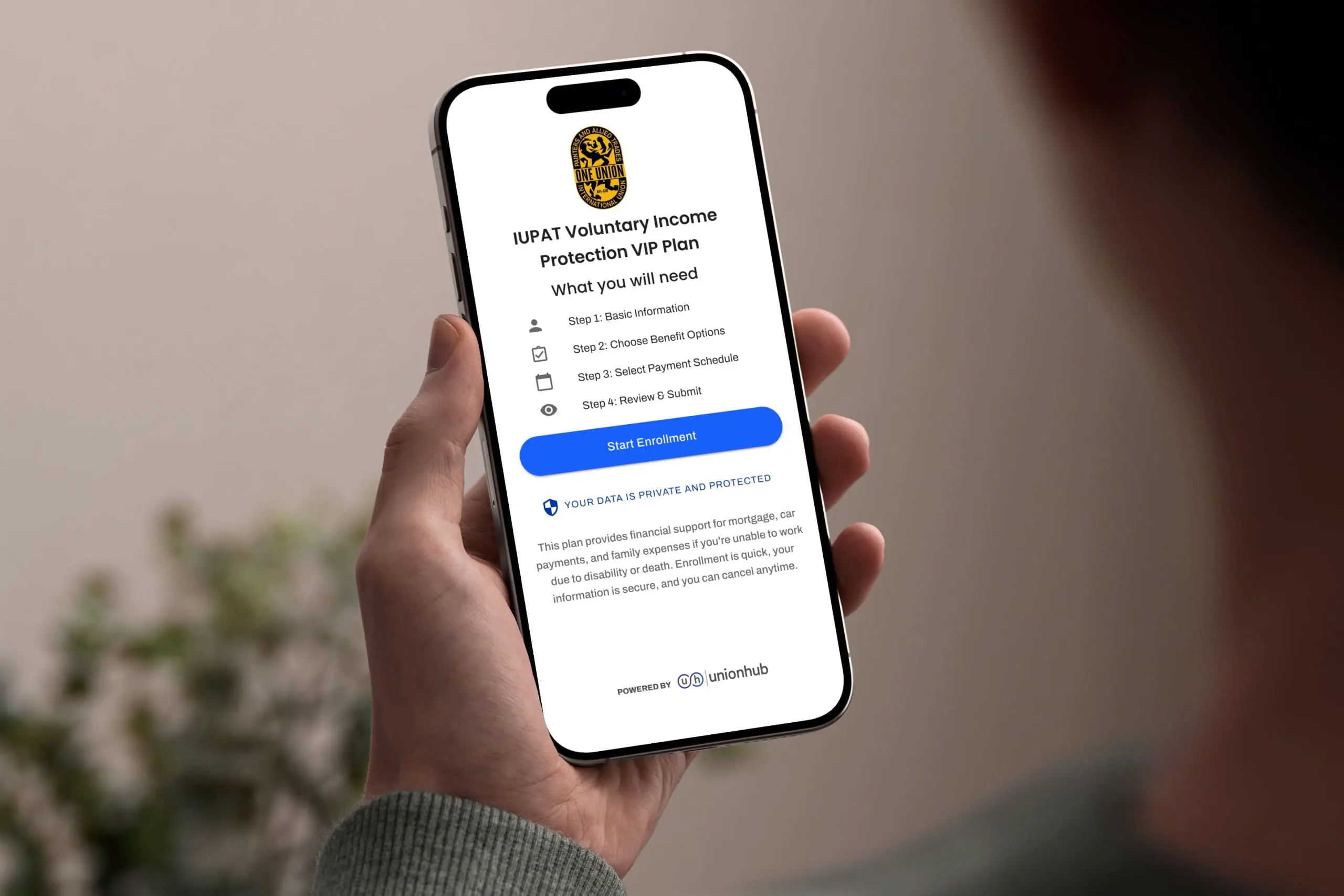

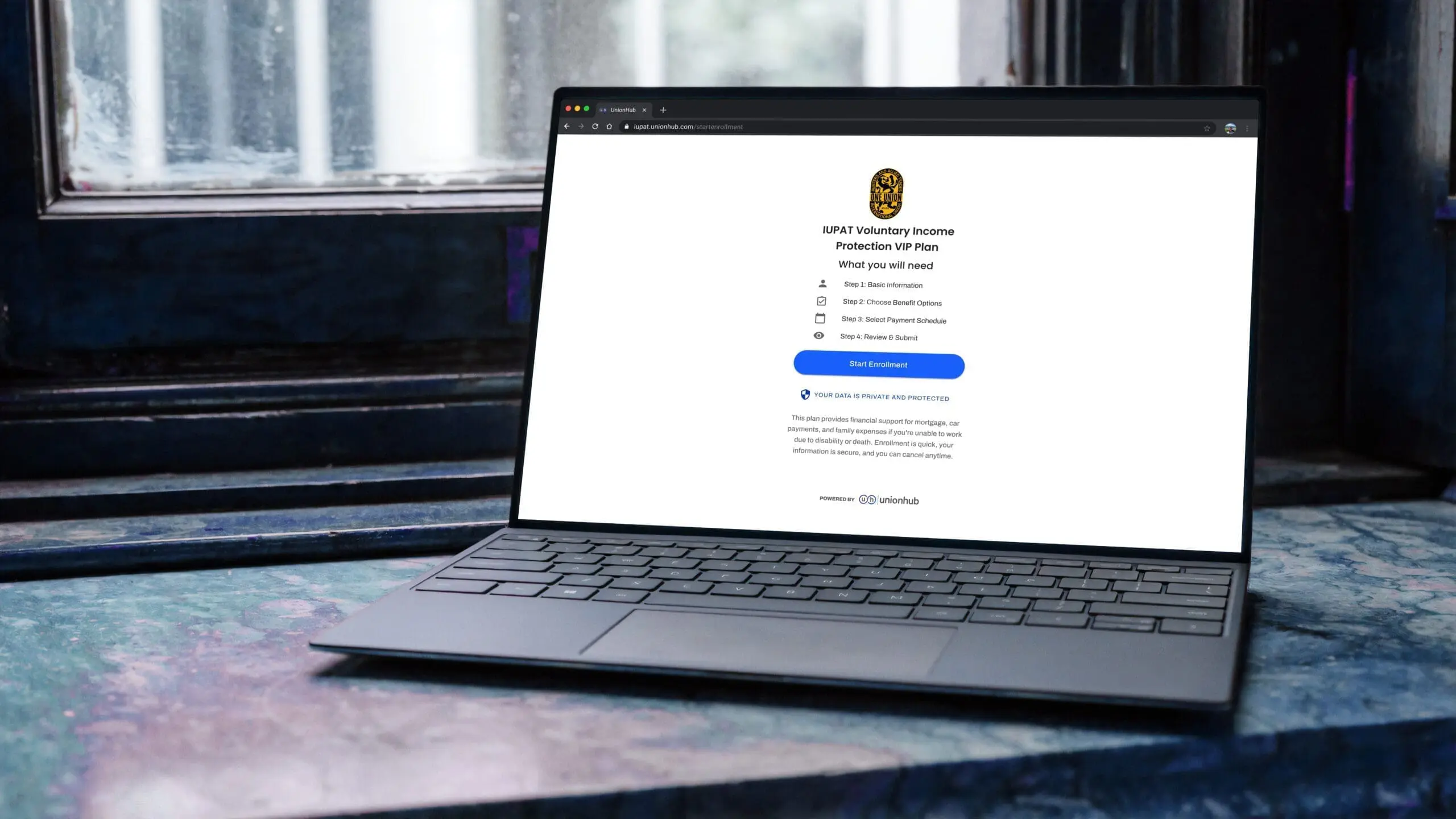

At iupatvip.com, we’re committed to making it easier and safer for you to manage your union and income protection benefits. That’s why we’ve teamed up with UnionHub, a cutting-edge platform that transforms how you access and manage your benefits and payments – all in one convenient place.

Why UnionHub?

No App Downloads Needed

UnionHub is built for simplicity. Access everything instantly without the hassle of downloading any apps.

Trusted Nationwide

With thousands of clients across the country, UnionHub is known for its unwavering reliability and top-tier security.

Secure and Easy to Use

Your security and convenience come first. With UnionHub, managing your benefits is simple, safe, and hassle-free.

Proudly U.S.-Based

With teams in Denver and Chicago, our staff consists of industry-leading professionals. Every component of UnionHub, from programming to security, is meticulously crafted with precision and expertise, showcasing the very best of American talent.

Payment Options with ACH

With ACH you control your payments by choosing the day or date that works best for your schedule. It can be your payday, a set date each month, or another time that fits your budget.

ACH is processed directly through the U.S. banking system’s clearing house network, making it a more secure and reliable option than credit card payments for recurring benefits.

Many Members choose UnionHub’s Pay Day Deduction System™, which aligns deductions with paydays or pay periods. This option keeps premiums in sync with income, reduces missed payments, and simplifies account management for Members and administrators.

Pay Day Deduction System™ is a proprietary trademark and payment system of UnionHub, Inc.

Your Secure Access to Benefits

In partnership with UnionHub, iupatvip.com provides an unmatched platform for managing your benefits and payments. More than just a tool, it’s your secure gateway to a seamless, worry-free experience with your IUPAT Voluntary Income Protection (VIP) benefits.

Important information about this plan

IMPORTANT: The monthly cost for coverage is based on your age at the start of the coverage and will increase on the policy anniversary date after you move into a new age bracket.

Participation in this program is voluntary, and the decision to enroll rests solely with the Members. Members are responsible for bearing all associated costs. A $2 technology fee is included in all listed monthly costs for the following coverages: Short-Term Disability and Long-Term Disability. A $1 technology fee is included in all listed monthly costs for the following coverages: Member Life and Spouse Life.

IMPORTANT: If you depart from the IUPAT, opt out of paying dues, or retire, you must notify the IUPAT VIP Customer Service Center at (224) 357-7880. Not doing so within 90 days could delay or negate your eligibility for a refund.

We encourage Members to thoroughly review the complete policy booklet. Email info@unionone.com to request a copy.

This program is administered by Union One Benefits Administration.

This voluntary benefit plan is classified as a Safe Harbor plan and, as such, is not subject to the Employee Retirement Income Security Act of 1974 (ERISA). The Union does not contribute to the premiums for this plan on behalf of its Members, does not endorse the plan, and does not require Members to enroll in the plan. Furthermore, the Union receives no financial or other consideration in connection with the administration or promotion of this program.

For STD & LTD: These policies provide disability income insurance only and do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

For Life: You have 31 days to notify Union One of your retirement if you wish to port or convert your Life Insurance.

Group Insurance coverages are issued by Metropolitan Life Insurance Company (MetLife). All Rights Reserved. METLIFE, and the METLIFE Logo are trademarks of MetLife.